nj property tax relief for veterans

A payment or a credit will be made by the CCRC to the claimant within 30 days after the CCRC receives its credited property tax bill. It was founded in 2000 and has since become a member of the American Fair Credit Council the US Chamber of Commerce and has been accredited through the International Association of Professional Debt Arbitrators.

Winndevelopment And Soldier On Inc Close Financing For 23 Million Veterans Housing Development In Tinton Falls Nj Soldier On

New Jersey voters gave a resounding yes to expand property tax benefits for veterans in last weeks election.

. Reservists and National Guard personnel must be called to active duty service to qualify. 100 Disabled Veteran Property Tax Exemption. If you are an.

Military Personnel Veterans. Public Law 2019 chapter 413 became operative when New Jersey voters approved a Constitutional Amendment effective December 4 2020 to eliminate the wartime service requirement for both the 250 Veteran Property Tax Deduction and the Disabled Veteran Property Tax Exemption. About the Company New Jersey Veterans Property Tax Relief.

More than 57000 veterans will soon be eligible for help paying their property taxes after New Jersey voters on Tuesday appeared to overwhelmingly support a change to. Veterans must have active duty military service with an honorable discharge. COVID-19 is still active.

More veterans can get. Reservists and National Guard personnel must be called to active duty service to qualify. Veteran property tax deduction.

COVID-19 is still active. There are four main tax exemptions we will get into in detail. Effective December 4 2020 State law PL.

New Jersey has long provided a property tax deduction of 250 to some wartime veterans and their surviving spouses. Covid19njgov Call NJPIES Call Center. An 100 percent disabled veteran will receive a full property tax exemption.

413 eliminates the wartime service requirement for the 100 Totally and Permanently Disabled Veterans Property Tax Exemption. However the total of all property tax relief benefits that you receive for 2021 Senior Freeze Homestead Benefit Property Tax Deduction for senior citizensdisabled persons and Property Tax Deduction for veterans cannot be more than the amount of your 2021 property taxes or rentsite fees constituting property taxes. Stay up to date on vaccine information.

Here are the details who would benefit and what it could cost. The 100 property tax exemption for disabled veterans is applicable only to taxes paid on a primary residence. A disabled veteran in New Jersey may receive a full property tax exemption on hisher primary residence if the veteran is 100 percent disabled as a result of wartime service.

It was founded in 2000 and is a member of the American Fair Credit Council the US Chamber of Commerce and is accredited by the International Association of Professional Debt Arbitrators. Be a legal resident of New Jersey. If you are a qualified Veteran Widow of a Veteran Senior Citizen Disabled Person or Surviving Spouse you may be eligible for deductions which reduce your property tax liability by 250.

About the Company Property Tax Relief For Veterans In Nj CuraDebt is a company that provides debt relief from Hollywood Florida. Active Military Service Property Tax Deferment. 100 disabled veteran property tax exemption.

Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Call NJPIES Call Center. Stay up to date on vaccine information.

They up come two different restrictions homicide videos and evoke the forum discussions at NJ. Phil Murphy spoke at the Department of Military and Veterans affairs Memorial Day ceremony in Wrightstown May 25. Their surviving spouse can collect the tax relief benefits.

Under certain conditions combined deductions may be allowed ie. Aside from tax relief programs you may be eligible for property tax exemptions in NJ. NJ Division of Taxation - Local Property Tax Relief Programs.

CuraDebt is a company that provides debt relief from Hollywood Florida. With respect to the 250 Veterans Property Tax Deduction the petax year is October 1 2020 with the deduction applied to the property taxes for calendar Year 2021. 6000 Veteran Income Tax Exemption Military veterans who were honorably discharged or released under honorable circumstances are eligible for a 6000 exemption on New Jersey Income Tax returns.

It was founded in 2000 and has since become an active participant in the American Fair Credit Council the US Chamber of Commerce and accredited with the International Association of Professional Debt Arbitrators. Active military service property tax deferment. Deductions that include Veterans and New Jersey Realtors.

Both Veterans and Senior Citizens. Property Tax Exemption for Disabled Veterans. Check Your Eligibility Today.

Breaking news from Atlantic Cumberland The Burlington County. Own the property. Effective December 4 2020 State law PL.

Effective December 4 2020 State law PL. 250 Veteran Property Tax Deduction. Mortgage Relief Program is Giving 3708 Back to Homeowners.

413 eliminates the wartime service requirement for the 250 Veterans Property Tax Deduction. Effective December 4 2020 State law PL. The 100 property tax exemption for disabled veterans is only applicable to taxes paid on a primary residence.

NJ Election 2020. To qualify as of October 1 of the pretax year you must. Public Law 2019 chapter 203 extends the annual 250 property tax deduction to veterans or their surviving spousecivil uniondomestic partner who are residents of a continuing care retirement community CCRC.

Veterans must own their homes to qualify. About the Company Property Tax Relief For Veterans In Nj. Veterans must have active duty service with an honorable discharge.

There are two parts to Public Question No. All Property Tax Relief Benefits are Subject to Change NJ FY 2019 Budget Passed July 1 2018. Active duty for training continues to be ineligible.

Ballot question asks voters if they want to extend property-tax relief for military veterans. New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader. You are eligible for a 6000 exemption 3000 for Tax Years 2017 and 2018 on your New Jersey Income Tax return if you are a military veteran who was honorably discharged or released under honorable circumstances from active duty in the Armed Forces of the United States on or any time before the last day of the tax year.

Focuses on the benefits of property the relief to New Jersey a tax deduction is granted from the taxes levied on the wrap. New Jersey Property Tax Reduction Through Exemptions and Deductions. 413 eliminates the wartime service requirement for the 250 Veterans Property Tax Deduction.

About the Company Nj Property Tax Relief For Veterans CuraDebt is a debt relief company from Hollywood Florida.

Veterans Services Borough Of Morris Plains Nj

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times

States With The Lowest Property Taxes 2022 Bungalow

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States

Plainfield School District Informs Charter Schools Their Students Also Subject To Address Verification Plainfield Nj News Tapinto

The Official Website Of Borough Of East Newark Nj Tax Water Collector

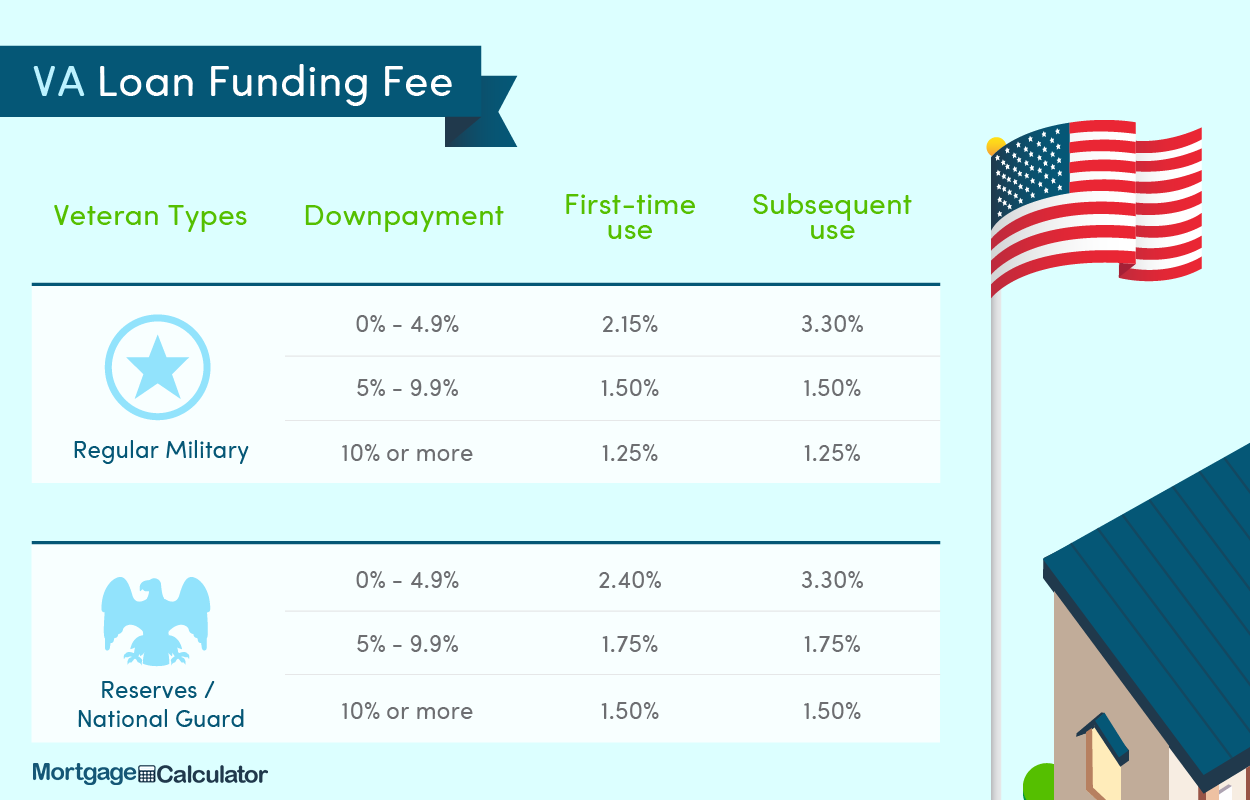

Va Loan Funding Fee Closing Cost Calculator

Veterans Services Borough Of Morris Plains Nj

Towns Where Property Taxes Hurt The Most In Each Of N J S 21 Counties Nj Com

Publicpolicy Nj Center For Nonprofits

States With The Lowest Property Taxes 2022 Bungalow

100 Disabled Veteran Benefits By State 5 Great States For 100 Disabled Veterans Va Claims Insider